In June 2011, in one of my earlier posting, http://businessmanagementbooksreview.blogspot.com/2011/06/from-asian-to-global-financial-crisis.html), I have predicted that the property market is due for a correction sometime in 2012 and one of the charts which I have shown in that posting is reproduced below:

Anyway, we all know that my prediction is WRONG and Malaysia continues to enjoy excellent growth in the property market (p.s. I have to admit that I am a pessimist). As such, I thought it will be a good time for me to do a review on the current property market in Malaysia. The first chart which I am sharing is an update of the above earlier chart as we now have information on the values of property transaction in 2011 and 2012 which is shown below:

.png)

So, from the updated chart, it appears to show that property transactions have reached its peak in 2012 and is it heading for a correction?

Next, I would like to share a chart which shows the house price index from 1988 to 2012 for terrace and high-rise properties in Malaysia:

From the graph, I would interpret as generally, the rise in house prices for terrace houses are still ok while for high-rise, it is not sustainable. It sort of makes sense because I would think that high-rise properties are more popular to speculators. What do you think?

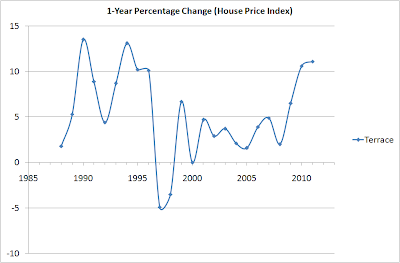

The above chart prompted me to analyse further the data and the two charts below show the 1-year percentage change of the house price index for terrace and high-rise respectively:

For terrace houses, it does appear the rate of increase is not too drastic but it does show some softening in 2012.

For high-rise, it does seem the recent run-up in prices is too drastic and steep correction is expected soon?

This makes me wonder which city is most susceptible to a price correction and for that, the chart below would offer some guidance:

At first look, we may have the impression that Pulau Pinang and KL are at risk of a steep price correction for high-rise properties but if we were to analyse the value of overhang properties, we can see some interesting numbers.

From the additional information, I would think that Selangor would be facing the highest risk of a steep price correction because of the following reasons:

a) The value of overhang properties increased significantly from Q1 2012 to Q1 2013, i.e. from RM394 Million to RM1.2 Billion!!!

b) To make matters worse, the unsold under construction properties is a staggering 9,077 units which increases from Q1 2012 where the unsold under construction units is 7,712.

As such, the value of overhang properties and number of unsold under construction units in Selangor have increased from Q1 2012 to Q1 2013 and for me, that is indicating some indigestion!!! And by the way, from an engineering point of view, the house price index for KL, Selangor and Pulau Pinang is increasing at an exponential rate since 2008/2009 and for fellow engineers or mathematicians, we all know how exponential increase will lead to infinity. So, we can interprete the chart in two ways, i.e. property prices will reach sky high or property price also cannot defy gravity and will need to fall down soon. I will leave the interpretation to you.

Have a good day.

.png)

No comments:

Post a Comment